Corporate law firm Schulte Roth & Zabel (SRZ), along with Mergermarket, recently released the findings of their annual survey Shareholder Activism Insight at SRZ's inaugural Shareholder Activism Conference in New York City this past week.

Here are a few survey results…

Not surprisingly, both activist and corporate respondents see a rise in shareholder activism over the upcoming 12 months. 60% of activists see a rise in shareholder activism versus 64% for corporate respondents.

This latter number is up from 39% in 2008. Only 4% of executives (and 0% of investors) actually see a decrease in shareholder activism over the upcoming 12 months.

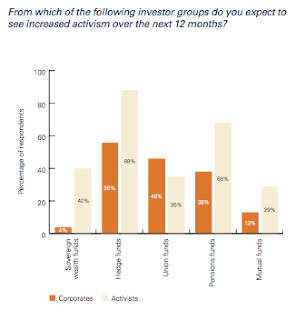

While both activists (88%) and corporates (56%) are in agreement that the most notable increases in shareholder activism in the next year will come from hedge funds, they disagree on the specifics. In terms of activism, excluding hedge funds, corporate respondents are most bullish on union funds; activist respondents, pension funds. All told, activists see a greater use of activism across all investor groups, except union funds, than corporate respondents do. While 46% of corporate respondents see an increased use of activism for union funds, only 35% of activists agree. Conversely, 40% of activists see a rise in activism amongst sovereign wealth funds, but only 4% of corporates expect an increase.

Perhaps most notably, respondents disagree as to which sectors will experience the greatest rise in shareholder activism over the next year and what catalysts will be responsible for this trend. Although a plurality of corporates (44%) and activists (26%) see shareholder activism rising most in the financial services industry, the latter class evidently has their eyes set on a more diversified portfolio. 22% of activists expect the greatest amount of activism to occur in the energy/utilities and technology/media/telecom industries each. 33% of corporates, not expecting a rise in technology/media/telecom targets, believe the greatest use of shareholder activism will take place in the energy/utilities industry, followed by 11% for chemicals/industrials (which activists, conversely don't expect any rise to take place in.) However, the most significant disagreements between corporates and activists arise when polled about catalysts. While 68% of activists see excessive cash on balance sheets (versus 15% for corporates) as the main driver of shareholder activism, 54% of executives see financial performance (versus 40% for activists) as the main driver. Activists see greater rises in activist investing due to every catalyst than corporates do (and quite significantly, at that), except for financial performance. Lastly, despite 50% of executives viewing activists as short-term market opportunists, nearly a majority (48%) of activists polled stated that their average holding period is in excess of a year.

With that said, there still is significant agreement between executive and activist respondents. For example, the two believe, by a substantial majority, that dialogue/negotiations is both the best strategy for activists, as well as for companies, to take in addressing shareholder activism. A plurality of activists (44%) and a majority of corporate respondents (57%) believe that investors and corporations work constructively on these negotiations most of the time, free from the limelight--which contrasts with media portrayals. Executives' views of activists have also improved over the last year, with 46% of executives viewing them as value driven co-owners and 74% of executives believing that shareholder board representation is important. Additionally, a majority of both parties believe "say on pay" rules will have the greatest impact on the extent of shareholder activism over the upcoming 12 months. 80% of activists and 72% of executives also expect investors to take advantage of proxy access, although technically in the long-term only executives (by a majority) expect this to be a long-term trend.

Despite the perceived impact of new regulations, only approximately 10% of corporates will respond by changing their composition of boards/senior management, their executive compensation structure, or their public relations strategies. Says David Rosewater, Partner at Schulte Roth & Zabel, "It is interesting to note that although more than half of the corporate executives responding state that the Dodd-Frank Act provisions will make them more responsive, very few believe it will change their behavior on relevant issues."

The report, which can be found here, is fascinating in the context of the major proxy campaigns taking place currently, the financial crisis, and the ruling going on over proxy access. Hedge Fund Solutions, LLC., as well as other consultants, have been counseling companies and investors in preparation for this increased and distinctive rise in shareholder activism.

Marc Weingarten and David Rosewater lead SRZ's shareholder activism practice.

Marc Weingarten and David Rosewater lead SRZ's shareholder activism practice.

|

| Marc Weingarten |

|

| David Rosewater |

SRZ has a preeminent practice specialty in activist matters, with an unparalleled expertise in the applicable securities laws, proxy rules and the current state of market practice. SRZ has been counsel in many of the highest-profile activist matters in recent years. Serving both issuers and activists, the firm advises on federal securities law, state corporate law, Hart-Scott-Rodino, proxy rules and related matters, as well as handling investigations and litigations arising out of activist activity.